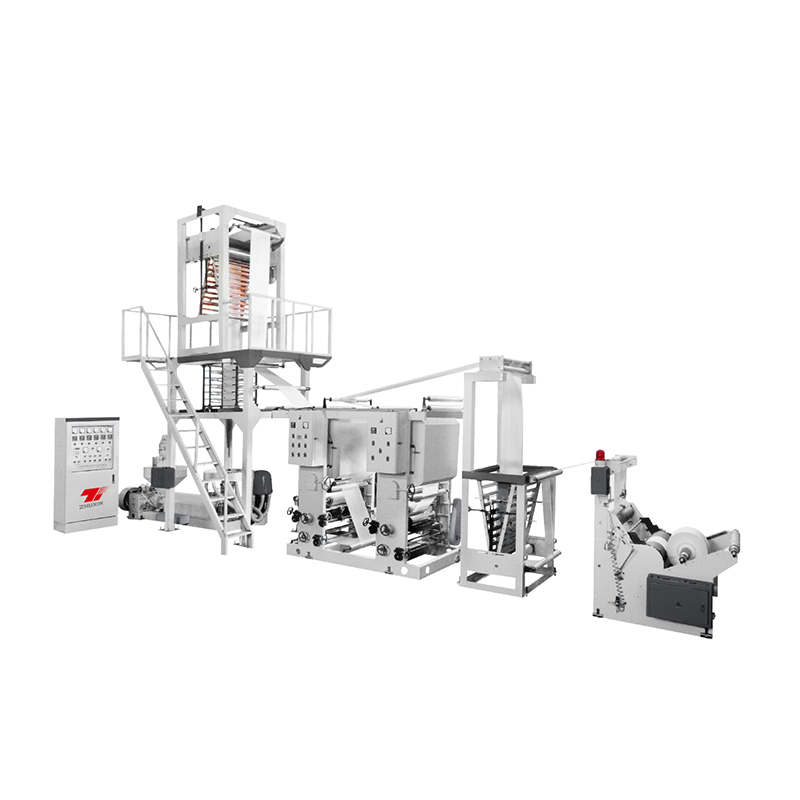

Since its establishment in 1989, Zhuxin has consistently focused on the R&D and manufacturing of film blowing equipment.

- Thirty years of professional expertise

- A pioneer across China's industry

- Patented technology assurance

- Comprehensive service system

.jpg)